Farm Income Down as Minnesota Farmers Plan for 2024

UNDATED (WJON News) - Last week, the USDA reported that 2023 farm income was down 21 percent from 2022’s levels.

As farmers turn the page to 2024, Al Kluis, managing director of Kluis Commodity Publishing says most crops are not profitable at the current market prices.

If you're aggressive with paying your cash rent, or if you've got higher land payments with interest rates going up, then a lot of farmers right now are, in a best-case scenario, breaking even. And in some cases, they plug in normal trend line yields, they're looking at losses on the 2024 crop. It's really a much tougher situation than we've been through.

While Kluis is expecting steady to slightly lower prices through planting season, the “Black Swan” events could always upset the markets.

There is a lot of what I call geopolitical risk, the uncertainty in the Black Sea, uncertainty about getting the ships around Africa through the Red Sea, and then the threat by China that they're going to take over Taiwan. If that were to occur, I think it would be incredibly negative not only (for) the stock market but for the commodity markets.

Kluis says wheat prices are not profitable at current market levels, and believes that will open the door for more corn and soybean acres throughout Minnesota in 2024.

When you look at new crop spring wheat prices, it's tough to pencil into breakeven. So I’m thinking that we'll have less spring wheat and that's going to open the door in the Northern Plains for more corn, soybeans, canola, and sunflowers.

Kluis remains optimistic that the July futures could return to above $5.00 in corn and $13.40 to $13.80 in soybeans.

READ RELATED ARTICLES

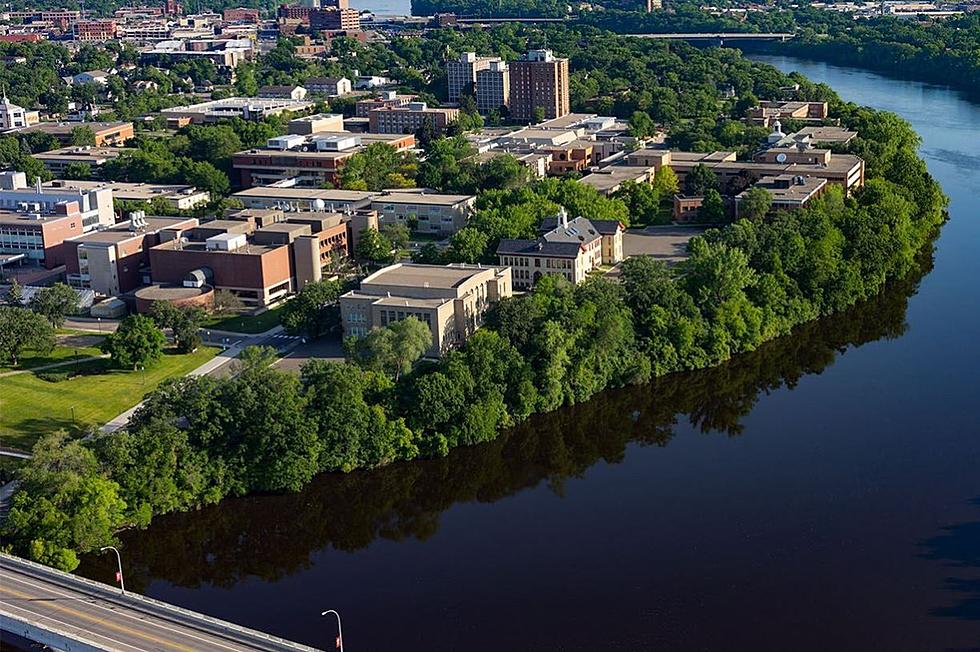

- NDSU Announces Tuition Waiver for MN Students

- U of M Campus Voted Least Fashionable

- Man Charged After Incident at Minnesota Nudist Resort

The 10 Coolest Street Names in St. Cloud

More From AM 1240 WJON