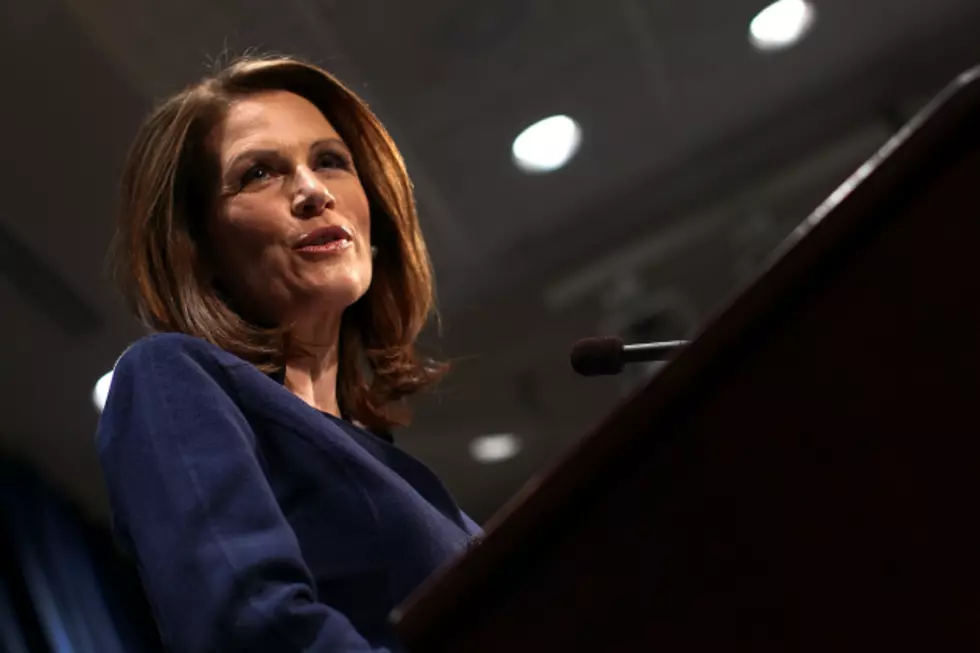

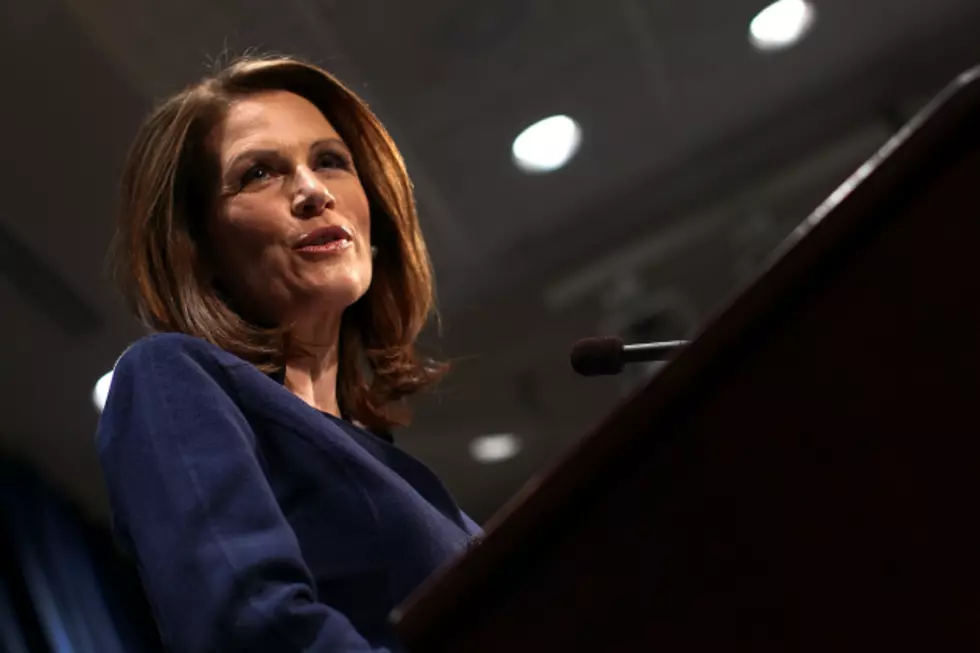

Bachmann Wants Tax Cuts Extended For All Americans

WASHINGTON, D.C. -- There has been a lot of talk on Capitol Hill over the Bush Era tax cuts. If Congress and President Obama can't come to a compromise by the end of the year, the cuts will expire and we'll all see an increase in our income taxes.

Republicans and Democrats agree the tax cuts should be extended for 98% of all Americans. However, their differences come with the top two-percent. President Obama wants to end the cuts for the highest earners, while the GOP doesn't.

Congresswoman Michele Bachmann says small business owners would be hurt.

The top two-percent includes individuals making over $200,000, or couples making more than $250,000.

According to Forbes Magazine, under Obama's proposal, a single person in this bracket would see a 9% increase in their taxes from $73,000 to $79,600. And a household would have an 8 1/2% increase from $63,600 to $69,000.

More From AM 1240 WJON

![Bachmann to Play Role in “Sharknado 3″ [VIDEO]](http://townsquare.media/site/67/files/2015/03/michele_bachmann_sharknado3_%252540igorbobic_twitter_630x420.jpg?w=980&q=75)

![St. Cloud Doctor Attending ‘State Of The Union’ Address [AUDIO]](http://townsquare.media/site/67/files/2014/01/State-Of-The-Union.jpg?w=980&q=75)