![O’Driscoll: Miffed with Governor’s Budget [AUDIO]](http://townsquare.media/site/67/files/2010/12/Tim-ODriscoll.jpg?w=980&q=75)

O’Driscoll: Miffed with Governor’s Budget [AUDIO]

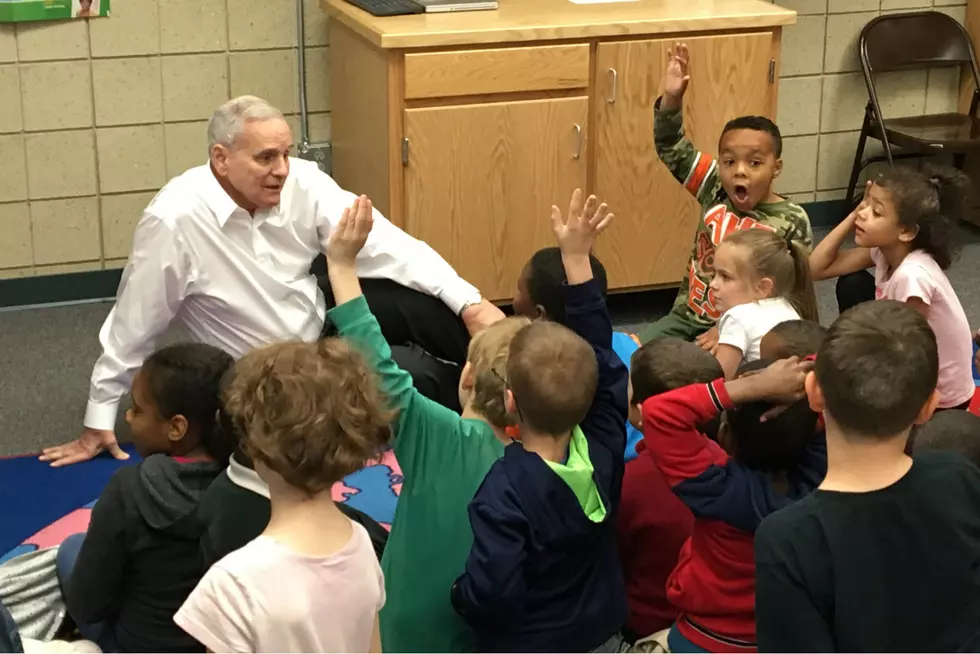

ST. PAUL - Governor Mark Dayton wants several changes to the state's tax code.

He unveiled his budget proposal today (Tuesday) which includes calling for an income tax increase for joint filers who make more than $250,000 and single filers who earn over $150,000. He also wants to drop the state's sales tax from 6.875 percent down to 5.5 percent, but expand what would be subject to the tax, including clothes over $100. And he wants to increase the cigarette tax by .94 cents. Republican State

Representative Tim O'Driscoll of Sartell says he's not thrilled with the Governor's plan.

The Governor is also proposing a property tax rebate of up to $500 for every Minnesota homeowner, and restore full funding of a property tax credit for renters.

O'Driscoll says he thinks the Governor wants to undo all the work the Republican majority did the past two years.

Part of the Governor's plan would be to spend an extra $52 per public school student, and push for all-day kindergarten.

Key aspects of the two-year budget proposed Tuesday by Gov. Mark Dayton:

—An overhaul of the state's tax system would generate $2.1 billion in revenue, half of which would pay down the state's deficit.

—Would impose additional 2 percent income tax on about 53,000 of the wealthiest taxpayers; reduce property taxes and the corporate tax rate for businesses; and give homeowners a property tax rebate of up to $500.

—Sales tax rate would drop to 5.5 percent, from 6.875 percent, but the state would start collecting taxes on more items like high-end clothes, online purchases and many services.

—Increases cigarette tax to $2.17 per pack, from $1.23, and also raises the tax on cigars and smokeless tobacco.

—Almost $600 million in new education funding, boosting spending per student in public schools, doling out more in scholarships and expanding access to all-day kindergarten.

—Delays repaying schools for cost shifts used to balance previous budgets until fiscal year 2017.

—Would expand state Medical Assistance program to cover 47,000 more children and pregnant women. The expansion is done in part by shifting people from other programs and by boosting the income levels that determine who qualifies.

—Would hike sales tax a quarter-cent in seven-county metro area to help fund Southwest light rail line from Eden Prairie to Minneapolis, and to expand bus service around the Twin Cities.

—Would expand access to Minnesota GI bill to give veterans better access to education and job training.

Copyright 2013 The Associated Press.

More From AM 1240 WJON