Investors Sue BMO Over Tom Petters’ Ponzi Scheme

MILWAUKEE (AP) - BMO Financial Group is facing four federal lawsuits filed by investor groups who claim a bank acquired by BMO was complicit in a $3.7 billion Ponzi scheme by a Minnesota man.

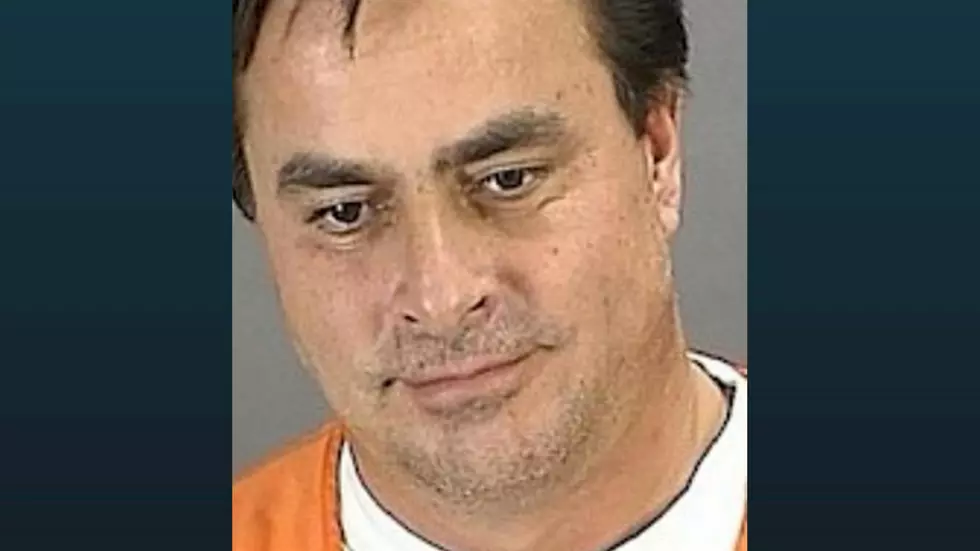

BMO acquired Marshall & Ilsley Corp. in 2011 and denies any wrongdoing by M&I, now known as BMO Harris. The lawsuits stem from M&I's dealings with Tom Petters, who's serving a 50-year federal prison sentence in Leavenworth, Kansas for masterminding the Ponzi scheme.

One of the lawsuits, seeking $24 billion, claims Petters did not act alone and that M&I legitimized and facilitated Petters' scheme. BMO spokesman Jim Kappel says there's no merit to the lawsuits' claims.

The 57-year-old Petters was convicted in 2009 of 20 charges, including money laundering and conspiracy.

More From AM 1240 WJON

![The College Of St. Benedict To Pay Back 600K Of Tom Petters’ Donation [AUDIO]](http://townsquare.media/site/67/files/2011/01/petters_260x148.jpg?w=980&q=75)