Dayton Administration Puts Finer Point on Tax Plan

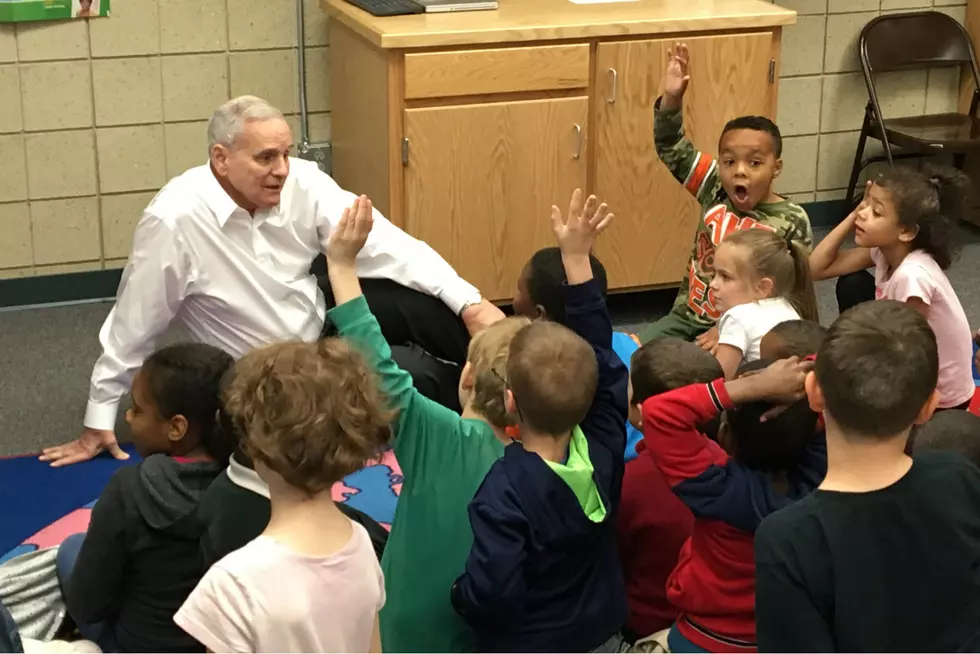

ST. PAUL (AP) - Gov. Mark Dayton's administration is striking back against perceptions that his proposed sales tax expansion would put Minnesota business at a disadvantage when bidding for service contracts in other states.

The Department of Revenue on Friday released updated information on how applying the sales taxes to services would work. Dayton has proposed a significant widening of the sales tax in conjunction with a push to lower the underlying rate from 6.875 percent to 5.5 percent.

The plan has produced howls of protest, particularly from companies that would have to pay sales tax on legal services, accountant contracts and other business-to-business transactions.

Some Minnesota business heads have complained it would hamper their competitiveness when bidding for out-of-state contracts.

The Revenue Department says when the recipient of a service is from out of state no tax is owed. When the buyer and seller are in the state, the tax would apply.

(Copyright 2013 by The Associated Press. All Rights Reserved)

More From AM 1240 WJON